Articles: The Need for Reform

COVID-19 Pandemic: Exposing LONGSTANDING problems

The coronavirus pandemic has further exposed the gaps and weaknesses in our current health care system. When the pandemic began, millions of people lost their jobs—and often, their health insurance. Even those who have coverage worry about how they will afford medical care should they contract COVID-19 or another illness and end up in the hospital.

Patients Getting Slammed by Surprise Costs Related to COVID-19

CBS News, October 12, 2020

“COVID-19 can do more than torment patients physically. It also clobbers some financially.

Even though many insurers and the U.S. government have offered to pick up or waive costs tied to the virus, holes remain for big bills to slip through and surprise patients.”

Coronavirus Likely Forced 27 Million Off Their Health Insurance

Axios, May 13, 2020

“Roughly 27 million people have likely lost job-based health coverage since the coronavirus shocked the economy, according to new estimates from the Kaiser Family Foundation.”

No Income. Major Medical Bills. What Life Is Like for Millions of Americans Facing Financial Ruin Because of the Pandemic.

Time, May 7, 2020

“After losing her job as a nanny in March, Robinson could no longer afford health insurance, so she’s been rationing her lupus and anxiety medications.”

“The safety net—already a dubious patchwork—grows more tattered. In normal times, not quite a third of workers who have lost jobs receive jobless benefits. In April and May, thousands waited weeks to get through to unemployment offices, sometimes only to be told they weren’t eligible. Then there is the added expense of health care. About 12.7 million Americans have likely lost employer–provided health insurance since the pandemic began, according to the Economic Policy Institute, adding to the 27.5 million who didn’t have it before this crisis.”

What Happens When Our Insurance Is Tied to Our Jobs, and Our Jobs Vanish?

Washington Post, Apr. 13, 2020

“More than 17 million people have filed for unemployment in the past four weeks as the novel coronavirus continues to drive the U.S. economy into recession. That means that millions are or soon will be without health insurance, and millions more will struggle to pay premiums and co-pays on insurance they do have.”

The Need for Reform

As of August 2020 (the latest data we have), an estimated 11.9% of New Mexico residents were uninsured (up from 10.5% in fall 2019, before the COVID-19 pandemic). And those who do have coverage face increasing premiums, higher out-of-pocket costs (copays, deductibles, and coinsurance), rising pharmaceutical drug prices, and expensive surprise billing by out-of-network doctors and specialists.

Because of the health care system we have in the United States, New Mexicans—and Americans across the country—forgo needed medical appointments and procedures, ration or stop taking necessary medications, worry about paying for care when they or family members become injured or ill, stay with an undesirable job simply to keep their health insurance, and when medical bills become overwhelming, even file for bankruptcy.

It’s time to change the system. It’s time to get Health Security started and provide New Mexicans with affordable, consistent access to the care and medicine they need.

Doctors Aren’t Burned Out From Overwork. We’re Demoralized by Our Health System.

New York Times, February 5, 2023

“Doctors have long diagnosed many of our sickest patients with ‘demoralization syndrome,’ a condition commonly associated with terminal illness that’s characterized by a sense of helplessness and loss of purpose. American physicians are now increasingly suffering from a similar condition, except our demoralization is not a reaction to a medical condition, but rather to the diseased systems for which we work.”

This strongly worded opinion from political anthropologist and physician Dr. Eric Reinhart explains the exodus of physicians from the American health care system. He says essentially that doctors also suffer from the lack of universal health care in the United States, and explores reasons many of them have traditionally thought it was in their interest to oppose it.

‘Why Is it So Expensive?’ We Asked People from Around the World What They Think of U.S. Health Care.

New York Times, April 28, 2021

“‘We asked eight people from around the world what they thought about American health care. It didn’t go well.’”

This expertly produced 6-minute visual presentation from the New York Times provides an outside perspective on our dysfunctional health care system—and makes a great case for why we need systemic change like the Health Security Plan.

Busting the Myth of the ‘Free Market’ Health Care System

Albuquerque Journal (Guest column by Dr. Arthur Vall-Spinosa), Nov. 30, 2020

“First, the idea that competition – free market principles of supply and demand – will lower cost is fallacious. Yes, ‘the market always wins,’ but not in health care . . .”

“Second, the notion that 180 million employees are happy with their employer-based health insurance may have been true when there was first-dollar coverage, but not any longer . . .”

“The third fallacy is ‘I want to choose my own doctor.’ The truth is that your employer chooses your health plan, and the health plan then assigns you to a doctor or you are asked to choose from a list on which most established or well-known doctors’ practices are closed and you have limited, if any, choice.”

This short column is well worth a read.

Everybody Covered: What the US Can Learn from Other Countries’ Health Systems

Vox, Feb. 12, 2020

“You hear it all the time: American health care spends more money and produces worse outcomes than many other developed countries’ systems. But why? What have other countries done to achieve universal health care, to cover everybody, that the United States has not? And what are the consequences of those choices?”

This 5-part series, made possible by a grant from The Commonwealth Fund, explores how other countries provide universal coverage.

Taiwan’s single-payer success story—and its lessons for America

Two sisters. Two different journeys through Australia’s health care system.

The Netherlands has universal health insurance—and it’s all private

The answer to America’s health care cost problem might be in Maryland

In 2020, the Campaign supported a global budgets memorial during the NM legislative session. This article focuses on global budgets and how they have functioned in Maryland.

In the UK’s health system, rationing isn’t a dirty word

Congress Showers Health Care Industry with Multibillion-Dollar Victory After Wagging Finger at It for Much of 2019

Washington Post, Dec. 20, 2019

“But this week, pharmaceutical companies, hospitals, insurance companies and medical device manufacturers practically ran the table in Congress, winning hundreds of billions of dollars in tax breaks and other gifts through old-fashioned lobbying, re-exerting their political prowess.”

“A bipartisan push to curb the practice of surprise medical billing was delayed until next year . . .

“A bipartisan bid to rein in prescription drug prices failed to advance . . .

“Pharmaceutical firms also won extended protections for select patents . . .

“The health-care industry ginned up broad support for repealing taxes that were central to the 2010 Affordable Care Act . . .”

Feeling the Pain: An Investigative Series by Albuquerque Journal Reporter Colleen Heild Examining the Severe Lack of Access to Timely Health Care in New Mexico

Albuquerque Journal, Feb. 26, 2019

A 4-part series on the problems facing New Mexico residents.

Part 1: Long Waits Frustrate Patients

Part 2: A Small Town Struggles to Find Doctors

Part 3: NM Faces Hurdles Recruiting Doctors

Part 4: Initiatives Could Bolster NM’s Physician Ranks

Health Care Costs

Health care costs—medical bills, insurance premiums, prescription drug prices, hospital costs—continue to rise, impacting individuals, families, and businesses.

Health Care Costs: Medical Bills

Bill of the Month

NPR and Kaiser Health News have teamed up to bring us the Bill of the Month series. These monthly installations are always worth a read. A sampling:

Retiree Living the RV Dream Fights $12,387 Nightmare Lab Fee

Dec. 23, 2020 • Traveling through New Mexico, retiree Lorraine Rogge “received a bill for more than $12,000 for a bundled lab test from Carlsbad Medical Center; her share was over $3,000.” An expert in lab billing weighed in: “Quite frankly, the retail prices on [the bill] are ridiculous; they make no sense at all," Root says. "Those are tests that cost about $10 to run."

A $41,212 Surgery Bill Compounded A Patient's Appendicitis Pain

Jan. 29, 2020 • A young man averted disaster after a friend took him to the nearest hospital just before his appendix burst. But more than a year later, he's still facing a huge bill for his out-of-network surgery.

For Her Head Cold, Insurer Coughed Up $25,865

Dec. 23, 2019 • A New York woman worried that her sore throat might be strep, so she went to the doctor to have it checked out. Then came the bill—with a price tag similar to a small SUV.

A Stunning Indictment of the U.S. Health-Care System, in One Chart

Washington Post, Dec. 10, 2019

“One quarter of American adults say they or a family member has put off treatment for a serious medical condition because of cost, according to data released this week by Gallup. That number is the highest it’s been in nearly three decades of Gallup polling.”

Health Care Spending Grew at a Faster Rate in 2018

Axios, Dec. 5, 2019

While this article covers 2018, its basic assertion remains true:

“U.S. health care spending climbed again not because people went to the doctor or hospital more frequently, but because the industry charged higher prices.”

Americans’ Struggles with Medical Bills Are a Foreign Concept in Other Countries

Los Angeles Times, Sept. 12, 2019

“In France, a visit to the doctor typically costs the equivalent of $1.12.

A night in a German hospital costs a patient roughly $11.

And in the Netherlands—one of the few wealthy nations other than the U.S. where patients face a deductible—insurers usually must cover all medical care after the first 385 euros, roughly $431.

Healthcare in the U.S. has long been unique. But few things so starkly set the American system apart as how much patients pay out of pocket for medical care, even if they have insurance.”

Investors’ Deep-Pocket Push to Defend Surprise Medical Bills

Kaiser Health News, Sept. 11, 2019

“As proposals to ban surprise medical bills move through Congress and state legislatures with rare bipartisan support, physician groups have emerged as the loudest opponents . . .

But as lobbyists purporting to represent doctors and hospitals fight the proposals, it has become increasingly clear that the force behind the multimillion-dollar crusade is not only medical professionals, but also investors in private equity and venture capital firms.

In the past eight years, in such fields as emergency medicine and anesthesia, investors have bought and now operate many large physician-staffing companies. And key to their highly profitable business strategy is to not participate in insurance networks, allowing them to send surprise bills and charge patients a price they set—with few limitations.”

Health Care Costs: Insurance Premiums

The Government Lawsuit Against Kaiser Points to an Immense Fraud Problem in Medicare

Los Angeles Times, Aug. 4, 2021

“But the allegations, and the Department of Justice’s decision to support them by becoming a co-plaintiff against Kaiser, point to a larger issue with Medicare — specifically, the Medicare Advantage program, which allows private health insurers rather than government administrators to provide coverage to seniors. The indications are that Medicare Advantage is profoundly infected with fraud.”

Our Top Private Health Insurer Is Rolling in Cash. And It’s Reducing Coverage

Los Angeles Times, July 20, 2021

“UnitedHealth Group, parent of UnitedHealthcare, the country’s largest private health insurer, earned $15.4 billion in profit last year. It took in more than $9 billion in profit during the first half of this year.

So what does a well-heeled insurer do amid such a windfall? It seeks to reduce people’s coverage, of course.”

Average Family Premiums Rose 4% to $21,342 in 2020, Benchmark Employer Survey Finds

Kaiser Family Foundation, Oct. 8, 2020

News Release | Summary of Findings | Report

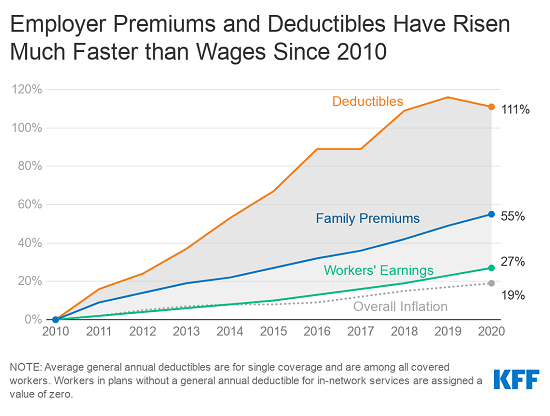

“In 2020, the average annual premiums for employer-sponsored health insurance are $7,470 for single coverage and $21,342 for family coverage. The average single premium increased 4% and the average family premium increased 4% over the past year. Workers’ wages increased 3.4% and inflation increased 2.1%.

The average premium for family coverage has increased 22% over the last five years and 55% over the last ten years.”

State Trends in Employer Premiums and Deductibles, 2010–2019

Commonwealth Fund, Nov. 20, 2020

“Premium contributions and deductibles were 10 percent or more of median income in 37 states in 2019, up from 10 states in 2010. Nine states (Arkansas, Florida, Louisiana, Mississippi, New Mexico, Oklahoma, South Carolina, Tennessee, and Texas) have combined costs of 14 percent or more of median income. Middle-income workers in New Mexico and Louisiana faced the highest potential costs relative to their income (17.4% and 17.2%, respectively).” [Emphasis added.]

State profile: New Mexico: Trends in Employer Insurance Costs, 2010–2019

Health Care Costs: Prescription Drugs

Costco Approach Could Have Saved Medicare $2.6 Billion in Drug Spending, Analysis Shows

CNN, July 6, 2021

A good article about the role pharmacy benefit managers (PBMs) play in keeping prescription drug costs high.

“Medicare spent billions more money on generic drugs for its beneficiaries than warehouse chain Costco did for the same drugs, according to an analysis published Tuesday.

This overspending hit $2.6 billion in 2018.”

Trends in Retail Prices of Brand Name Prescription Drugs Widely Used by Older Americans, 2006 to 2020

AARP Public Policy Institute, June 2021

Lots of findings in this comprehensive annual report. Here’s just one:

“Between January 2006 and December 2020, retail prices for 65 chronic-use brand name drugs that had been on the market since the beginning of the study period [2005] increased cumulatively by an average of 276.8 percent.

The cumulative general inflation rate in the US economy was 32.0 percent during the same 15-year period.”

Hundreds of Prescription Drugs Are Costlier in 2020

AARP, Jan. 6, 2020

“Retail prices for 460 prescription drugs are increasing by an average of 5.2 percent in 2020—more than double the projected rate of inflation for this year, according to data analyzed by 3 Axis Advisors, a health care research firm.”

The Shocking Rise of Prescription Drug Prices

Consumer Reports, Nov. 26, 2019

An in-depth article on the many factors that increase what we pay for medications.

“Indeed, to pin all the blame on Big Pharma is an oversimplification. How much a consumer pays for meds is also driven in part by drug supply system middlemen whose wheeling and dealing with drugmakers contributes to rising drug costs, according to multiple government reports and industry experts. Shrinking insurance coverage is another part of the problem, with greater numbers of Americans paying a larger share or even the full price of their medication.”

Health Care Costs: Hospitals

Across the country, many rural hospitals are struggling to survive—and some have closed, leaving area residents with long drives to get the care they need. At the same time, hospitals are inflating their bills and coming after patients who have little or no ability to pay.

Hospitals and Insurers Didn’t Want You to See These Prices. Here’s Why.

New York Times, Aug. 22, 2021

This is a must-see visual presentation from the New York Times.

“This year, the federal government ordered hospitals to begin publishing a prized secret: a complete list of the prices they negotiate with private insurers. . . .

But data from the hospitals that have complied hints at why the powerful industries wanted this information to remain hidden.

It shows hospitals are charging patients wildly different amounts for the same basic services: procedures as simple as an X-ray or a pregnancy test.

And it provides numerous examples of major health insurers — some of the world’s largest companies, with billions in annual profits — negotiating surprisingly unfavorable rates for their customers. In many cases, insured patients are getting prices that are higher than they would if they pretended to have no coverage at all.”

1 in 4 Rural Hospitals Is Vulnerable to Closure, a New Report Finds

Vox, Feb. 18, 2020

“2019 was the worst year for rural hospital closures this decade, with 19 hospitals in rural America shutting their doors. Nearly one out of every four open rural hospitals has early warning signs that indicate they are also at risk of closing in the near future.”

The ‘Follow-Up Appointment’

Washington Post, Aug. 17, 2019

“So far this year, Poplar Bluff Regional Medical Center has filed more than 1,100 lawsuits for unpaid bills in a rural corner of Southeast Missouri, where emergency medical care has become a standoff between hospitals and patients who are both going broke.”

“What Moore found in some of those itemized receipts didn’t make sense to him either: $75 for a surgical mask; $11.10 for each cleaning wipe; $23.62 for two standard ibuprofen pills; $592 for a strep throat culture; $838 for a pregnancy test. He searched through court records and discovered that the hospital was collecting hundreds of monthly garnishments from hourly employees at places like Quickstop, Earl’s Diner, Wendy’s, Instant Pawn and Alan’s Muffler.”

As Patients Struggle with Bills, Hospital Sues Thousands

Most hospitals do not frequently take patients to court over medical debt. But since 2015, Carlsbad Medical Center, in New Mexico, has filed lawsuits by the thousands.

New York Times, Sept. 3, 2019

“People across the country are coping with soaring medical costs, opaque pricing and surprise bills, but these issues are felt acutely in one-hospital towns like Carlsbad, where residents have few options for care—and must pay whatever prices the hospital sets.”

“In a presentation to the state legislature in 2015, the mining company Intrepid Potash, a major employer in Carlsbad, calculated that it would be cheaper for one of its workers to travel to Hawaii for a gall bladder operation—including airfare for two, and a seven-day island cruise—than to get the procedure at the local hospital.”

‘UVA Has Ruined Us’: Health System Sues Thousands of Patients, Seizing Paychecks and Putting Liens on Homes

Washington Post, September 9, 2019

“Unpaid medical bills are a leading cause of personal debt and bankruptcy, with hospitals from Memphis to Baltimore criticized for their role in pushing families over the financial edge. But UVA Health System stands out for the scope of its collection efforts and how persistently it goes after payment, pursuing poor as well as middle-class patients for almost all they’re worth, according to court records, hospital documents and interviews with hospital officials and dozens of patients.”

The Affordable Care Act / OBAMACARE

The 2010 Patient Protection and Affordable Care Act (ACA) has enabled many New Mexicans to gain coverage (mostly through expanded Medicaid) and, true to its name, includes some important patient protections, such as requiring insurers to cover preexisting conditions. The ACA was a positive step forward, but we have further to go.

And although the ACA has now survived three efforts to have the Supreme Court strike it down, it has been weakened by other actions (see “Trump Is Trying Hard to Thwart Obamacare. How’s That Going?” below), and there may well be more challenges in the future. We simply cannot rely on the ACA being secure.

The Affordable Care Act and Health Security

Section 1332 (the Waiver for State Innovation) of the Affordable Care Act allows states to develop and implement alternatives to the health insurance exchange approach, as long as certain criteria are met. One such alternative is the NM Health Security Plan. For more on the Affordable Care Act’s Waiver for State Innovation and the Health Security Plan, click here.

the Affordable Care Act: ITS IMPACT, and ATTACKS AGAINST IT

Supreme Court Declines to Overturn ACA — Again

Kaiser Health News, June 17, 2021

For the third time, the Affordable Care Act has survived a challenge in the Supreme Court.

“It was the third time in nine years the court has been offered the opportunity to effectively end the health law — and the third time it has refused.”

New SCOTUS Conservative Bloc Could Overturn ACA, with Big Impacts on NM

NM Political Report, October 22, 2020

While this particular threat has been defeated, the article shows how much New Mexico depends on the ACA.

“But Russell Toal, New Mexico Superintendent of Insurance, said repealing the ACA would ‘disproportionately affect New Mexico more than most states.’

He said that nearly 300,000 would lose Medicaid coverage immediately and an additional 800,000 to 900,000 would lose protections for preexisting conditions.”

10th Anniversary of the Affordable Care Act

March 23, 2020, marked the 10th anniversary of the Affordable Care Act. It came at a time when the COVID-19 pandemic had just begun to seriously impact the United States. Larry Levitt, the Executive Vice President for Health Policy at the Kaiser Family Foundation, tweeted the following:

“Monday is the 10th anniversary of the ACA. It’s far from perfect and health care is still unaffordable for many. But, nearly 20 million more people have insurance. As we deal with a double whammy of health and economic crises, a significant safety net would be missing without it.

Where we'd be in this public health crisis without the ACA:

About 20 million more people uninsured.

People with pre-existing conditions, at greatest risk for severe illness from COVID-19, locked out of individual insurance.

Annual and lifetime limits for many with insurance.

The ACA presented trade-offs, including taxes and higher premiums for some, in exchange for increased health coverage and pre-existing condition protections.

I suspect many will view those trade-offs differently as we face a public health crisis and job losses simultaneously.”

10th Anniversary of the ACA: A Time to Reflect on Its Impact and Refocus Efforts on the Act’s Purpose and Goals

Trust for America’s Health, Mar. 23, 2020

“Prior to the ACA, more than 44 million non-elderly adults were uninsured. By 2016, that rate of uninsured people reached a historic low as approximately 20 million Americans gained access to health insurance coverage under the ACA including 12 million adults who gained coverage due to Medicaid expansion.”

Trump Is Trying Hard to Thwart Obamacare. How’s That Going?

NPR, Oct. 14, 2019

After “repeal and replace” efforts failed, “the president and his administration shifted to a piecemeal approach as they tried to take apart the ACA.” This article outlines five actions that the Trump administration has taken to damage the Affordable Care Act.

1. Individual mandate eliminated

2. States allowed to add "work requirements" to Medicaid

3. Cost-sharing reduction subsidies to insurers have ended

4. Access to short-term "skinny" plans has been expanded

5. Funds to facilitate HealthCare.gov sign-ups slashed

With the Affordable Care Act’s Future in Doubt, Evidence Grows That It Has Saved Lives

Washington Post, Sept. 30, 2019

“ . . . Such findings are part of an emerging mosaic of evidence that, nearly a decade after it became one of the most polarizing health-care laws in U.S. history, the ACA is making some Americans healthier—and less likely to die.

The evidence is accumulating just as the ACA’s future is, once again, being cast into doubt. The most immediate threat arises from a federal lawsuit, brought by a group of Republican state attorneys general, that challenges the law’s constitutionality.”

Reproduced by kind permission of the artist. This cartoon is 13 years old. Isn’t it time for real change?